Real Estate Market Outlook 2026: What's Next for Charlotte, NC After a Year of Shifts?

Charlotte's real estate market has undergone a remarkable transformation throughout 2025, moving from the frenzied bidding wars of the pandemic era into a more measured, balanced environment. As we look ahead to 2026, the Queen City stands at an inflection point—where rising inventory, stabilizing prices, and evolving buyer dynamics are reshaping the landscape for homeowners, investors, and first-time buyers alike.

The Great Rebalancing: What Happened in 2025

The Charlotte housing market in 2025 told a story of normalization. After years of breakneck appreciation and scarcity-driven competition, the market finally exhaled. Active listings topped approximately 4,800 homes by mid-2025, representing a 24% increase from the previous year and marking the highest inventory levels the market has seen in nearly a decade.

This inventory surge fundamentally altered market dynamics. Homes began spending an average of 38 days on the market in June 2025, a 36% increase compared to the same period in 2024. The days of properties selling within hours were definitively over, replaced by a more deliberate process that gave buyers time to negotiate and sellers reason to price competitively.

Despite the cooling tempo, Charlotte's market demonstrated remarkable resilience. Closed sales in June 2025 reached 3,378, representing an 8.2% increase over June 2024. The market wasn't collapsing—it was maturing.

Home prices held steady throughout this transition. In September 2025, Charlotte home prices stood at a median of $415,000, up 2.5% compared to the previous year. This modest appreciation reflected a market finding equilibrium rather than experiencing the dramatic swings that characterized earlier years.

Economic Fundamentals: Charlotte's Structural Advantages

Charlotte's real estate market doesn't exist in a vacuum—it's powered by robust economic fundamentals that continue to attract residents and businesses. The city's population surpassed 920,000 in 2024, with a metro economy anchored by major institutions like Bank of America, Wells Fargo, and Honeywell.

The city's position as America's second-largest banking center (behind only New York) provides economic stability that many markets lack. This diversified employment base, coupled with growing tech and healthcare sectors, creates sustained housing demand that transcends short-term market fluctuations.

Migration patterns remain favorable. While some Florida markets experienced price corrections due to insurance costs and oversupply, Charlotte benefited from continued in-migration from higher-cost markets in the Northeast and Midwest. The combination of career opportunities, relatively affordable housing, and quality of life continues to draw thousands of new residents monthly.

The Rental Market: A Temporary Reprieve

Charlotte's rental market experienced its own recalibration in 2025, offering tenants relief after years of aggressive rent increases. Average rents across Charlotte in early 2025 showed an average year-over-year increase of 3.5%, with the highest growth seen in two-bedroom units.

This moderation resulted from a significant influx of new apartment supply. Thousands of new multifamily units hit the market throughout 2024 and early 2025, temporarily increasing vacancy rates and forcing landlords to offer concessions.

However, this tenant-friendly environment appears to be temporary. Experts predict that as the supply of new apartments slows down, the vacancy rate will decrease and rent prices will begin to rise in 2026. The construction pipeline that flooded the market with new units has dramatically slowed, setting the stage for tightening conditions ahead.

Charlotte's multifamily vacancy may remain above the national average through 2025 before stabilizing in 2026, with rents expected to see only modest increases through 2025 before turning positive in late 2025 and resuming a more normalized upward trend in 2026.

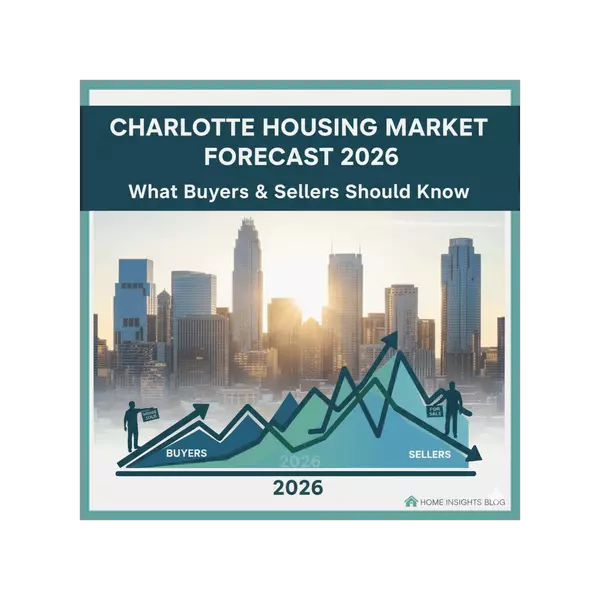

2026 Forecast: Cautious Optimism with Regional Variations

As we peer into 2026, multiple factors suggest Charlotte's market will continue its stabilization trajectory with modest appreciation. National forecasters provide a generally positive outlook. The National Association of Realtors anticipates existing home sales to increase by 11% in 2026, new home sales to rise by 5%, and median home prices to increase modestly by 4% in 2026.

For Charlotte specifically, most analysts project continued price growth. The median home price is expected to rise by 3.5% to 4.8% in 2026, offering solid equity growth for buyers who enter the market now. This would put median home prices in the $430,000 to $435,000 range by late 2026.

However, the outlook isn't uniformly rosy across all submarkets. Some analyses show Charlotte's home price forecast score at 37 out of 100, indicating a buyer's market with year-over-year home value growth dropping to -0.4% in 2025, though this more bearish projection represents one view among several.

The key variable remains mortgage rates. Mortgage rates are expected to average 6.1% in 2026. If rates decline more aggressively than currently projected, pent-up demand could flood the market, accelerating price appreciation. Conversely, if rates remain elevated or rise, the market's recovery could stall.

Neighborhood Spotlight: Where Opportunity Meets Growth

Not all Charlotte neighborhoods will perform equally in 2026. Neighborhoods like South End, NoDa, and Plaza Midwood are forecasted to outperform the metro average, providing enhanced returns for investors targeting high-demand locations.

South End, with its walkability, light rail access, and proximity to Uptown, continues to attract young professionals and empty nesters seeking urban amenities. The neighborhood's transformation from industrial district to Charlotte's trendiest address shows no signs of slowing.

NoDa (North Davidson) maintains its appeal as Charlotte's arts district, offering a unique blend of character, culture, and accessibility. Its historic homes and creative energy attract buyers seeking authenticity in an increasingly polished city.

Plaza Midwood's eclectic mix of bungalows, local businesses, and community character makes it perennially popular among first-time buyers and investors alike.

Suburban markets like Ballantyne and Huntersville offer different value propositions. These areas provide newer construction, excellent schools, and family-friendly amenities at more accessible price points than close-in neighborhoods. Suburban areas like Ballantyne and Huntersville are particularly attractive, offering a balance of new supply and strong interest from renters.

Strategic Considerations for Buyers

For homebuyers eyeing 2026, the Charlotte market presents a significantly different opportunity than recent years. The return of negotiating power represents the most significant shift. Multiple-offer scenarios, while still possible on well-priced properties, are no longer the default.

Buyers should approach the market with patience but also readiness. While inventory has improved, Charlotte is not experiencing the oversupply that plagues some Sunbelt markets. Quality properties in desirable locations still move relatively quickly.

The mortgage rate environment will largely dictate timing decisions. Waiting for lower rates is a gamble—if rates drop substantially, competition will intensify and may offset any savings from lower borrowing costs. A better strategy may be to buy when you find the right property and refinance later if rates improve.

First-time buyers face particular challenges. While the frenzy has subsided, affordability remains stretched. With a median home price of $405,000, a 10% down payment amounts to $40,500, a substantial barrier for many young households. Down payment assistance programs and exploring neighborhoods slightly farther from the urban core may provide pathways to ownership.

Implications for Sellers

Sellers entering 2026 must adjust expectations formed during the pandemic-era market. The days of receiving offers within hours of listing and selling above asking price are largely over for all but the most exceptional properties.

Pricing strategy is paramount. Overpriced listings languish, and each week a property sits on the market diminishes its appeal. Working with agents who understand current market dynamics and comparable sales data is essential.

Home preparation matters more now. With buyers having time to compare options, properties must show well. Professional photography, thorough cleaning, and addressing deferred maintenance are no longer optional for sellers wanting top dollar.

Timing remains favorable, particularly relative to higher-cost markets. Charlotte's strong fundamentals mean sellers aren't operating in a declining market—they're simply in a more balanced one. Those with strong reasons to sell shouldn't delay hoping for a return to 2021 conditions that aren't coming back.

Investment Perspective: Long-Term Value Creation

Real estate investors should view Charlotte's 2026 outlook through a long-term lens. The city's structural advantages—population growth, job creation, and relative affordability—support sustained appreciation over five-to-ten-year horizons.

Charlotte continues to offer strong potential for both homebuyers and real estate investors in 2025 and into 2026, with the city's expanding economy, relatively affordable housing market, and consistent population growth making it an attractive destination for long-term property ownership.

The rental market presents particularly interesting opportunities. Current softness allows investors to acquire multifamily properties or single-family rentals at more favorable prices. With vacancy rates expected to stay relatively stable around 4.5% to 4.7%, and rents rising by 3% to 4.5%, landlords in Charlotte can expect stable cash flow and strong tenant retention.

Short-term tactical considerations shouldn't overshadow strategic positioning. Charlotte's trajectory over the next decade remains positive. The temporary market softness of 2025 may represent an entry point that future buyers will wish they had seized.

The Infrastructure and Development Wildcard

Charlotte's real estate future is being literally built before our eyes. Billions in development projects are reshaping neighborhoods from Uptown to the suburbs. Major construction is reshaping neighborhoods, with development concentrated in Uptown, South End, west Charlotte, and east Charlotte.

Transit expansion, particularly extensions to the light rail system, will create new pockets of value. Historically, proximity to transit has commanded premium pricing in Charlotte's most successful neighborhoods. Future rail corridors will likely follow similar patterns.

Zoning reforms aimed at increasing density and housing supply may gradually impact neighborhood character and values. While controversial in some communities, these changes address the fundamental supply-demand imbalance that has made housing less affordable.

The Bottom Line: Stability, Not Stagnation

Charlotte's real estate market in 2026 will likely be characterized by steady, sustainable growth rather than dramatic swings. After the volatility of recent years, this stability may feel anticlimactic, but it represents a healthier, more predictable environment for all participants.

The market isn't going to crash, nor is it returning to pandemic-era frenzy. Instead, Charlotte appears positioned for modest appreciation supported by genuine economic fundamentals rather than speculative excess.

The market has shifted from the frenzy of 2021 into a healthier, more balanced environment. This normalization creates opportunities for prepared buyers, reasonable expectations for sellers, and solid foundations for long-term investors.

The Queen City's crown remains secure. As one of America's fastest-growing metros with diverse economic drivers and strong quality of life, Charlotte's real estate fundamentals remain sound. The question isn't whether Charlotte's market will grow, but rather at what pace and in which neighborhoods.

For those paying attention, 2026 may offer the sweet spot—a market balanced enough for thoughtful decision-making, but positioned for continued appreciation as the decade progresses. In real estate, as in life, timing isn't everything, but understanding the moment you're in certainly helps.

Categories

Recent Posts