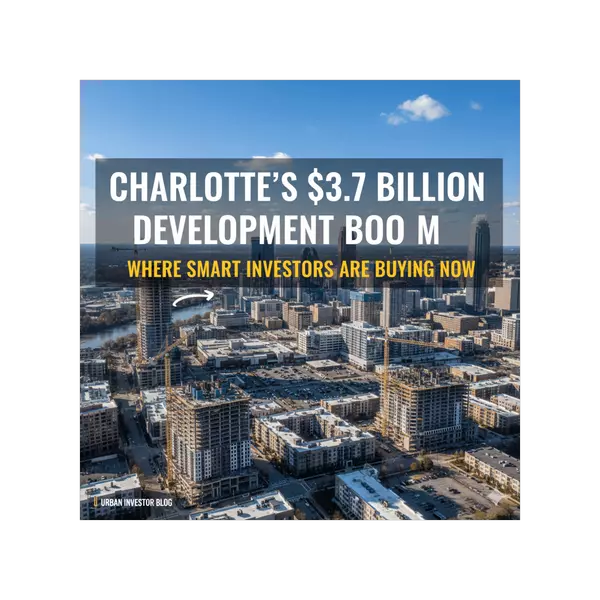

Charlotte's $3.7 Billion Development Boom: Where Smart Investors Are Buying Now

Walk through Charlotte today, and you'll witness something remarkable. Construction cranes dot the skyline from South End to Midtown, abandoned malls transform into vibrant mixed-use neighborhoods, and what was once underdeveloped west Charlotte land prepares to become the city's next Ballantyne. This isn't just another growth cycle. Charlotte's urban core has nearly four billion dollars in development either under construction or breaking ground by 2026, and savvy investors are positioning themselves now—before prices reflect what's coming.

The Numbers Tell a Powerful Story

Charlotte's development pipeline includes over 2.2 million square feet of office space, more than 338,000 square feet of retail, over 1,600 hotel rooms, and approximately 7,100 new apartments across the urban core. But here's what most people miss: this figure has actually decreased from previous years, not because Charlotte stopped growing, but because major projects finished construction and exited the pipeline. The 23-story office tower at 110 East in South End? Completed. Multiple luxury residential towers? Move-in ready. The pipeline refreshed itself.

Meanwhile, another trend emerged that smart investors pay attention to—adaptive reuse and historic preservation. More than 1.7 billion dollars flows into rehabilitating older assets, from empty office towers to the NFL stadium. The old Duke Energy headquarters converts into the Brooklyn & Church project with 448 apartments and 55,000 square feet of ground-level retail. Former textile mills house artists' studios and creative businesses. This dual-track approach—new construction paired with thoughtful renovation—creates opportunities at multiple price points.

The River District: Charlotte's Most Ambitious Project

Spanning 1,400 acres along the Catawba River between Charlotte Douglas International Airport and Uptown, The River District represents one of the largest master-planned communities in the Southeast. First residents move into Westrow, the initial phase, in late 2025. The development promises a complete live-work-play environment with residential neighborhoods, retail corridors, office space, and over 30 miles of trails connecting to riverfront access.

Developers often compare The River District to Ballantyne, and for good reason. Both communities offer that rare combination of suburban tranquility with urban accessibility. The River District sits minutes from Uptown and the airport, yet provides the kind of outdoor amenities—parks, greenways, even a working 2-acre sustainable farm—that families and professionals crave.

Here's the investment angle most people overlook: properties adjacent to The River District still trade at relatively affordable prices. West Charlotte historically lagged behind other quadrants in appreciation, but that gap narrows quickly as commercial activity ramps up. Investors acquiring single-family homes or small multi-family properties just outside the district boundaries position themselves for significant appreciation as the development matures over the next five to seven years.

Eastland Yards: From Mall Memories to Modern Community

Mention Eastland Mall to longtime Charlotte residents and watch the nostalgia flow. The massive shopping center once served as East Charlotte's retail anchor before closing in 2010. Now, that 80-acre site undergoes complete transformation into Eastland Yards, a mixed-use community that honors its past while embracing the future.

Phase one brought 38 homes ranging from 1,800 to 2,200 square feet, priced in the mid-500s. These properties sold briskly, validating market demand. Future phases add 300-plus homes, townhomes, and apartments, along with parks, sports facilities, senior housing, and retail space. The project doesn't just add housing—it returns to East Charlotte what disappeared when the mall closed: a community gathering place, economic activity, and pride.

Investment opportunities here extend beyond purchasing new construction. Properties in surrounding neighborhoods like Optimist Park and Belmont benefit from the spillover effect. As Eastland Yards attracts restaurants, retailers, and employers, nearby areas become more desirable. Investors who buy before that transition completes enjoy the appreciation that follows infrastructure investment.

The Light Rail Effect: Following the Silver Line

Charlotte's Blue Line proved what light rail does for property values. South End transformed from an industrial corridor into one of the city's most desirable neighborhoods, with property values near stations increasing 40 percent or more since the line opened. The Blue Line Extension to UNC Charlotte sparked similar growth in University City and NoDa.

Now attention turns to the Silver Line, a proposed 29-mile light rail system connecting Belmont through Uptown to Matthews and potentially Union County. While construction timelines push into the 2030s for phased openings, smart investors don't wait for the ribbon cutting. Properties within half a mile of proposed Silver Line stations already attract attention from buy-and-hold investors willing to play the long game.

Consider the trajectory: station location announcements happen first, then zoning changes around those stations to allow higher-density development, then early developer interest, and finally property value appreciation that reflects the coming connectivity. Investors entering during the station planning phase—where we are now—capture the most upside.

Focus areas include properties along Independence Boulevard heading toward Matthews, the Wilkinson Boulevard corridor heading west toward Belmont, and neighborhoods within walking distance of proposed stations. These locations offer shorter commute times to major employment centers even before the light rail opens, then benefit from the premium buyers pay for transit access once service begins.

Midtown's Vertical Expansion

Midtown Charlotte continues its dramatic transformation as the area between Uptown and Plaza Midwood fills with residential towers, restaurants, breweries, and retail. The 27-story Metropolitan tower adds 283 luxury units including two-story penthouses with private hot tubs, multiple outdoor pools, a private bar, and a rooftop speakeasy. Completion comes in late fall 2026.

Why does Midtown matter for investors? The neighborhood bridges Charlotte's biggest office submarkets—Uptown and South End—while offering a vibrant walkable lifestyle that attracts young professionals and empty nesters alike. Medical facilities anchor the area, including the Wake Forest Medical School campus that opened in June 2025. Healthcare represents one of Charlotte's most stable employment sectors, creating consistent rental demand.

Investors here target different strategies than in emerging neighborhoods. Midtown properties command premium prices but attract tenants willing to pay for location, amenities, and walkability. The risk profile skews more conservative—less dramatic appreciation potential but steadier cash flow and lower vacancy risk.

South End and Uptown: The Premium Play

While this article focuses on emerging opportunities, Charlotte's established urban core continues delivering for investors who have the capital for premium properties. South End home values average around $393,000 with steady yearly increases, and two-bedroom apartments rent for approximately $2,500 monthly. Uptown captures the executive rental market with luxury condos and apartments serving corporate relocations and high-income professionals who prioritize proximity to banking and financial services employers.

These neighborhoods offer what institutional investors call "core" assets—lower risk, predictable returns, and professional tenant pools with strong credit profiles and long-term stability. Individual investors compete with REITs and pension funds for these properties, but opportunities exist, particularly in smaller buildings or unique properties that don't fit institutional investment criteria.

The Corporate Headquarters Magnet

Charlotte's residential real estate story connects directly to its corporate growth. Over the past five years, Charlotte emerged as one of the Southeast's top destinations for corporate headquarters relocations. Honeywell, LendingTree, Albemarle, Odyssey Logistics, and DetraPel either moved or expanded here. The merger of Six Flags and Cedar Fair brought a combined headquarters to Charlotte, adding another major employer.

Each headquarters relocation triggers a wave of high-earning professionals searching for housing. These employees often relocate quickly, need temporary housing before buying, and have generous relocation budgets. Investors who position properties near major employment centers—Uptown, Ballantyne, University City—capture this demand.

The employment picture also influences which neighborhoods appreciate fastest. Areas with 30-minute or shorter commutes to multiple job centers outperform more isolated locations. This partially explains why neighborhoods along the I-77 and I-485 corridors consistently show strong appreciation—they provide access to downtown, the airport, and suburban office parks.

Timing the Market: Why Now?

Real estate investors obsess over timing, and several factors suggest now presents a compelling entry point for Charlotte properties:

Market conditions shifted from the frenzied 2021-2022 period when homes sold within hours and prices climbed monthly. Days on market increased to 38 days in mid-2025, up 36 percent from the prior year. Active listings reached 4,817 in June 2025, a 24 percent increase and the highest inventory in nearly a decade. These metrics don't signal a crash—they indicate a return to normalcy where buyers have negotiating power.

Development activity slowed temporarily due to higher interest rates and economic uncertainty, meaning fewer new projects compete for the same tenant and buyer pools. Developers who continued building—like Northwood Ravin with its calculated risk approach—position themselves to deliver properties when supply tightens again and demand continues escalating.

The infrastructure investments happening now—The River District, Eastland Yards, the Silver Line planning, medical campus expansion—create value that takes years to fully materialize. Investors who buy before these catalysts complete their transformation capture appreciation as the market reprices properties to reflect improved infrastructure and amenity access.

Where the Smart Money Goes

Different investor profiles target different opportunities:

Value investors focus on neighborhoods adjacent to major developments. Properties within a mile of The River District, surrounding Eastland Yards, or near proposed Silver Line stations offer the highest appreciation potential if infrastructure investments proceed as planned.

Cash flow investors target areas like University City where student housing and young professional rentals provide consistent demand, or Steele Creek where family-oriented tenants sign longer leases and maintain properties better than transient renters.

Premium investors compete for properties in established neighborhoods like South End, Plaza Midwood, or Dilworth where lower vacancy risk and stable appreciation justify higher entry prices.

Adaptive reuse specialists explore opportunities in the Iron District, along Central Avenue, or in Belmont where historic buildings convert into creative office space, live-work units, or mixed-use developments.

The common thread connecting successful investors across all these strategies? They understand Charlotte's growth isn't slowing—it's maturing. The city adds more than 120 new residents daily. The population increased over 20 percent in the past decade. Mecklenburg County projects to surpass 2.5 million residents in coming years.

Due Diligence Considerations

Before investing, examine several critical factors:

Transportation access remains paramount. Properties near existing or planned transit, major highways, or in walkable neighborhoods with amenities command premiums and appreciate faster.

School quality matters even for investors who don't have school-age children. Families prioritize education, and neighborhoods with strong public schools enjoy lower vacancy rates and longer tenant tenures.

Development pipelines in surrounding areas indicate future supply. A neighborhood might seem undervalued until you discover three apartment complexes breaking ground within two miles, flooding the rental market with new units.

Zoning and future land use reveal what could get built next door. That vacant lot might allow a 20-story tower that blocks your property's views and changes the neighborhood character.

Historical appreciation trends provide context for realistic return expectations. Some neighborhoods consistently deliver 5-7 percent annual appreciation while others spike dramatically during growth periods then stagnate.

The Long View

Charlotte's $3.7 billion development boom represents more than impressive construction statistics. It signals a city transitioning from regional banking center to diversified economic powerhouse attracting corporate headquarters, medical institutions, technology companies, and the talented workforce those employers need.

The developments completing in the next few years—The River District's first phases, Eastland Yards expansion, Midtown towers, adaptive reuse projects across multiple neighborhoods—create the infrastructure supporting Charlotte's next million residents. Investors who position themselves now, as these transformative projects move from blueprints to reality, capture the value creation happening in real time.

The question isn't whether Charlotte continues growing. Demographic trends, corporate relocations, and infrastructure investments ensure that. The question for investors: which neighborhoods offer the best combination of appreciation potential, cash flow, and risk profile given your specific investment thesis?

Whether you target emerging neighborhoods with higher risk and reward, stable areas with predictable returns, or premium properties in established districts, Charlotte's development boom creates opportunities across the investment spectrum. The investors who benefit most? Those who do their homework, understand neighborhood dynamics, and act while properties still trade at pre-transformation prices.

Ready to explore Charlotte's investment opportunities? Contact us today to discuss which neighborhoods and property types align with your investment goals. Our team specializes in helping investors identify high-potential properties before the market fully prices in the coming development.

Categories

Recent Posts