How to Set Realistic Expectations Before Buying Your First Home

Buying your first home is one of the most exciting milestones in life. However, the journey to homeownership can be both thrilling and overwhelming. Setting realistic expectations from the beginning can help you navigate the process with confidence and make decisions that align with your goals.

Here are some key steps to help you set realistic expectations before purchasing your first home:

1. Understand Your Budget

Before you start house hunting, take a close look at your finances. Calculate how much you can afford for a down payment, monthly mortgage payments, property taxes, insurance, and maintenance costs.

Speak with a mortgage lender to get pre-approved for a loan. This step not only clarifies your budget but also shows sellers that you're a serious buyer. Remember, your pre-approval amount is the maximum you can borrow, not necessarily what you should spend.

2. Identify Your Needs vs. Wants

It’s important to distinguish between what you need in a home and what you’d like to have. Consider factors like:

-

Number of bedrooms and bathrooms

-

Proximity to work, schools, or public transportation

-

Yard size and pet-friendly features

While granite countertops or a pool might be desirable, focusing on essentials will help you stay within budget and find a home that meets your basic requirements.

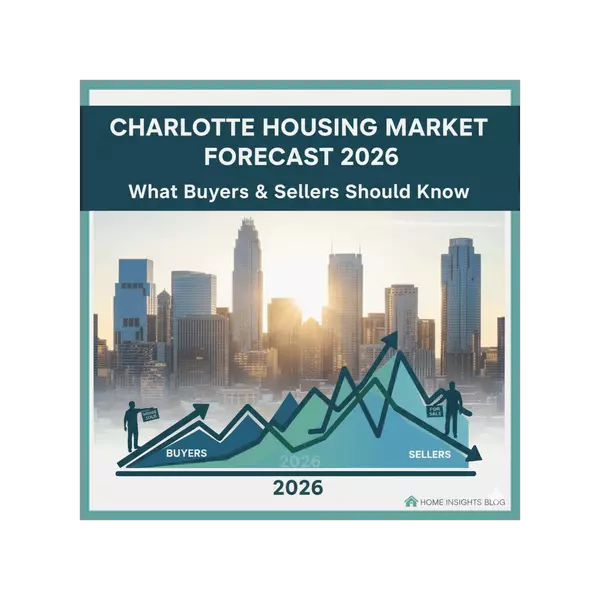

3. Research the Market

Real estate markets vary widely by location. Spend time researching neighborhoods and property values in your area of interest. Look at comparable sales to get a sense of what’s realistic within your price range.

Keep in mind that some markets are more competitive than others. You may need to act quickly or compromise on certain features if you’re buying in a high-demand area.

4. Factor in Additional Costs

Beyond the purchase price, there are additional costs to consider, such as:

-

Closing costs (typically 2-5% of the loan amount)

-

Home inspections

-

Moving expenses

-

Future repairs and upgrades

Being aware of these expenses will help you avoid surprises and stay financially prepared.

5. Be Prepared for Compromises

No home is perfect—especially your first one. Be open to making compromises while staying true to your priorities. Sometimes, a slightly longer commute or a smaller yard can be worth it to stay within budget.

6. Work with a Trusted Real Estate Agent

A knowledgeable real estate agent can guide you through the home-buying process and help you set realistic expectations. They understand the local market, can negotiate on your behalf, and will keep your best interests at heart.

7. Consider Both New Construction and Resale Homes

While new construction offers modern designs and fewer immediate repairs, resale homes often provide better value with features like established landscaping, appliances, and character. Weigh the pros and cons of both options before deciding.

8. Think Long-Term

Your first home doesn’t have to be your forever home. Think about how long you plan to live there and whether the property suits your future needs. Buying a home is a significant investment, so choose one that aligns with your lifestyle and financial goals.

Final Thoughts

Setting realistic expectations before buying your first home can make the process smoother and more enjoyable. With proper planning, clear priorities, and expert guidance, you can confidently take this big step toward homeownership.

If you’re ready to begin your journey or have questions about the process, reach out to a trusted real estate professional who can help you every step of the way. Your dream home is closer than you think!

Categories

Recent Posts