Frequently Asked Questions About Buying and Selling Real Estate in Charlotte, NC

by Heidi Hines

Charlotte, North Carolina, is one of the fastest-growing cities in the United States, making it a prime location for real estate. Whether you're looking to buy your first home or sell your current property, navigating the Charlotte real estate market can be challenging. In this guide, we'll answer the most common questions homebuyers and sellers have and provide expert advice on how to make the process as smooth and successful as possible.

1. Is Charlotte a Good Place to Buy a Home?

Charlotte is an excellent place to buy a home for several reasons:

-

Growing Economy: The city’s strong economy is driven by its financial sector, which is home to big players like Bank of America and Wells Fargo. This creates job opportunities, which in turn drives the housing market.

-

Diverse Neighborhoods: Charlotte offers a range of neighborhoods that suit all lifestyles. From the trendy South End with its walkable streets to the family-friendly Ballantyne, there is something for everyone.

-

Relocation Hub: Many people are moving to Charlotte due to its affordability compared to other major cities like New York or San Francisco. As a result, the demand for homes continues to increase, making it a great investment for homebuyers.

Despite the growth, Charlotte’s housing market is still relatively affordable, especially when compared to other big cities like Atlanta or Washington D.C. The average home price in Charlotte is increasing, but it remains below the national average.

2. How Do I Get Pre-Approved for a Mortgage in Charlotte?

The mortgage process can be a daunting part of buying a home, but getting pre-approved for a mortgage can help streamline your search. Here’s how to get started:

-

Check Your Credit Score: Your credit score plays a significant role in the mortgage approval process. A score of 620 or higher is generally needed for most loans, but the better your score, the better the rates you’ll receive.

-

Gather Financial Documents: Lenders will ask for documents such as proof of income, tax returns, and bank statements. Be prepared to submit these in order to verify your financial stability.

-

Find a Lender: The next step is finding a reputable lender. Many local banks and credit unions offer competitive rates for Charlotte buyers. You can also explore online lenders, but be sure to research their reputation and reviews.

-

Get Pre-Approved: After submitting your financial documents, the lender will assess your creditworthiness and determine how much they are willing to lend you. Once pre-approved, you’ll have a clearer understanding of your budget, making it easier to focus on homes in your price range.

Pre-approval also gives you an advantage in a competitive market. Sellers are more likely to accept offers from buyers who have already been pre-approved for a mortgage.

For more on the pre-approval process, check out this informative article by Bankrate.

3. How Much Should I Budget for a Down Payment?

One of the first questions you’ll face when buying a home is how much you need for a down payment. While many buyers believe that 20% is necessary, there are options available with lower down payments:

-

FHA Loans: These loans are backed by the Federal Housing Administration and only require a 3.5% down payment for buyers with a credit score of 580 or higher.

-

VA Loans: If you’re a veteran or active-duty military, you may qualify for a VA loan, which requires no down payment at all.

-

Conventional Loans: Some conventional loans only require as little as 3% down, especially for first-time homebuyers.

While putting down a smaller amount may make buying a home more accessible, keep in mind that the larger your down payment, the lower your monthly mortgage payment will be.

4. How Do I Find the Best Neighborhood in Charlotte?

Charlotte is home to many diverse neighborhoods, each offering unique features and benefits. The key is finding an area that matches your lifestyle and budget. Some of the best neighborhoods in Charlotte include:

-

Ballantyne: Ballantyne is a family-friendly neighborhood known for its excellent schools, beautiful parks, and upscale homes. It’s ideal for those seeking suburban living with close proximity to Charlotte’s job centers.

-

South End: South End is one of the trendiest neighborhoods in Charlotte, perfect for young professionals who enjoy a lively atmosphere with breweries, restaurants, and art galleries. The area is also close to public transit, making it easy to commute to other parts of the city.

-

Dilworth: Dilworth offers a mix of historic charm and modern amenities. With tree-lined streets, beautiful homes, and easy access to Uptown Charlotte, it’s one of the city’s most desirable neighborhoods.

If you’re unsure which neighborhood is right for you, consider working with a real estate agent who knows the area well. They can provide personalized recommendations based on your preferences and needs.

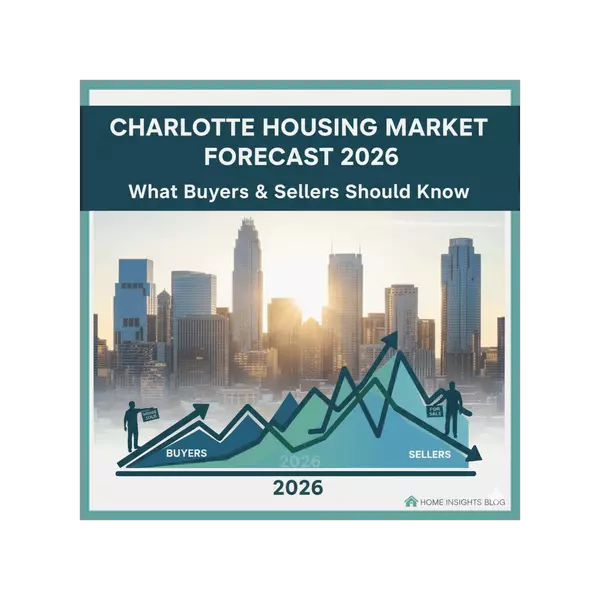

5. How Long Does It Take to Buy a Home in Charlotte?

The time it takes to buy a home in Charlotte depends on several factors, including the availability of homes, your financing process, and market conditions. On average, the entire home-buying process takes about 30 to 45 days. However, if you’re in a competitive market, like Charlotte, it can take longer due to bidding wars and multiple offers.

To avoid delays, start the process early by getting pre-approved for a mortgage and working with a knowledgeable agent who can help you navigate the market.

6. Should I Sell My Home Before I Buy?

One of the toughest decisions when moving is whether to sell your current home before buying a new one. Here are some considerations:

-

Selling First: If you sell your current home first, you’ll have the capital to make an offer on a new home without worrying about carrying two mortgages. This can provide peace of mind but might result in a gap between selling and buying, which means you’ll need temporary housing.

-

Buying First: On the other hand, buying a new home first can be advantageous if you need to find a place to live right away. However, you may need to manage both a mortgage on your old home and a new one until you sell.

Discuss your options with a local real estate agent to determine which approach is best for you based on your timeline and financial situation.

7. How Do I Determine the Value of My Home?

When it comes to selling your home, determining its value is crucial to setting an appropriate listing price. A few common ways to determine your home’s value include:

-

Comparative Market Analysis (CMA): A CMA compares your home to similar properties that have recently sold in your area. This is typically done by your real estate agent.

-

Online Estimators: Websites like Zillow provide estimated values of homes based on recent sales data, but these can be inaccurate.

-

Appraisal: An independent appraiser can provide a more formal estimate of your home’s value, which can be helpful when setting a price.

If you’re planning to sell, reach out to a local expert for a more precise valuation of your home.

8. What Are Closing Costs?

When you buy or sell a home in Charlotte, you’ll encounter various closing costs. For buyers, common closing costs include:

-

Loan origination fees

-

Appraisal fees

-

Title insurance

-

Inspection fees

Sellers will typically pay:

-

Agent commission fees

-

Repairs

-

Transfer taxes

On average, closing costs range between 2% to 5% of the home’s purchase price.

9. What Are the Benefits of Working with a Real Estate Agent?

While some buyers and sellers may try to navigate the real estate market on their own, working with a professional can provide many benefits:

-

Expert Guidance: A knowledgeable agent can help you navigate the complexities of contracts, inspections, and negotiations.

-

Market Insight: Real estate agents are familiar with local market conditions and can give you valuable insight into pricing, trends, and property values.

-

Time-Saving: An agent will handle the details, so you can focus on other aspects of your life, like packing and moving.

Real estate agents typically charge a commission of around 5% to 6% of the sale price, but their expertise is often well worth the investment.

10. How Can I Get Started Today?

If you’re ready to take the next step in your real estate journey, don’t hesitate to reach out to Charlotte NC Real Estate Source. We’re here to help you find the perfect home or sell your current property. Here’s how to get started:

-

Call Us: Speak with one of our expert agents at [Insert Phone Number].

-

Email Us: Send a message to [Insert Email Address].

-

Visit Our Website: Contact Us Online.

Final Thoughts

Charlotte’s real estate market offers incredible opportunities for both homebuyers and sellers. By understanding the process and getting expert advice, you can make informed decisions and achieve your real estate goals with confidence.

Categories

Recent Posts